New Blockchains and NFTs in Gaming — No Copy Cats!

Cosmetic Collectibles (skins and stuff)

“Wanting something does not give you the right to have it.” Ezio Auditore, Assassin’s Creed 2

Many things already have a digital representation today — legal contracts, music, video, photos, written content among others. While the creation of such digital representations on platforms such as YouTube and others became increasingly easy, the authenticity, ownership rights and provenance of them became increasingly challenging.

Enter blockchain and the Non-Fungible Token (NFT), an immutable, tokenized representation of a digital asset. It is a unique thing, which means it can be owned as one would own an (analog) diamond ring or an avatar in a game, and it can also be bought, sold or traded. The ”non-fungible” aspect of an NFT refers to its provable and unique representation of a given digital asset. It is a scarce object, meaning not only that its issuer can constrain its supply as needed, but also that its owner can distinguish its characteristics apart from all other imitators. This quality enables digital use cases that far better mirror possession of physical objects than do our current Web 2.0 solutions, whether it’s the issuance of a single land deed or that of 1,000 (but only 1,000!) copies of a rare trading card.

Back to the analogies, an NFT is superior to a diamond ring (Everledger tracked diamonds are exceptions of course) because it can’t be stolen or counterfeited. It exists on the digital ledger of a given blockchain network so its provenance and any subsequent changing of hands remains verifiable in perpetuity.

An NFT is superior to an avatar or similar in-game purchases as we know them today because a game publisher can shut down a game, throwing such purchases onto a pile of abandoned code.

Even more compelling is the opportunity for digital abstraction of otherwise-burdensome processes: consider the ramifications of every watt of energy in a smart grid, or every invoice issued by a vendor, being uniquely codified as an NFT. It quickly becomes apparent that this scarce-token model presents a compelling foundation for digital systems across all corners of the economy.

The specific use case with near-term promise that I would like to discuss is Cosmetic Collectibles, which exist at the intersection of videogames and social networks. To get a sense for the potential size of this market, consider this past year’s Fortnite phenomenon: Lendedu recently conducted a study on spending in the game and reported in June that two thirds of players said they spend money in the free to play game. And they are spending an average of $85. Of the dollars spent, 59% is going to skins. Think about this — Fortnite has 125m players according to Epic’s blog post in June. So if this sample set is indicative, roughly 86m people have spent $50 on average just to express their style in the game.

While this propensity of millennials to spend on functionally-useless avatars might strike older observers as odd, consider this: The physical economy has goods and services that relay clout and status. Think Gucci, Chanel, Ligne Roset furniture. Why won’t the digital economy, in a world being eaten by software, have a similar niche for status symbols? As millennials continue to own fewer physical goods and spend more time online, this trend will only continue.

I use the qualifier Cosmetic here because while I do fully understand the appeal of earning a sword or other weapon in one game and using it in another, it seems implausible that a game publisher who has spent time and resources calibrating their game would allow foreign objects to enter and possibly upend game dynamics. It would be analogous to a movie producer allowing a viewer to bring in another plot line, which is the thing they have strategically, meticulously and artfully crafted. However, allowing for unique avatars to be ported across games, especially “freemium” social games and traditional MMOs (massively multiplayer online games), would allow for savvy gamers to promote (i.e. stream) their personal brand more consistently.

As this degree of interoperability achieves greater normalization, one could also imagine individual game publishers seeking to gain more constant exposure for their brands as well. Nintendo’s newest console, which has a controller with a screen that detaches and becomes a mobile console, serves as confirmation for this. For publishers without Big N’s hardware capabilities, a standardized protocol for in-game objects and achievements would make it possible to outsource the development of auxiliary mobile apps to third parties. What we are left with is an ecosystem for any given title, in which the player can make verifiable progress even while away from their console or computer.

The dynamic in video games is important.

First, younger gamers (18–29) are driving this move to buying digital assets. According to some recent data from ACI and Newzoo, gamers spend more of their overall budgets on downloaded / digital games and in game purchases than boxed goods and subscriptions. More detail in the report indicates that this is being driven by younger gamers who are far less likely than older gamers (aged 30–40) to be spending their budget on traditional boxed goods.

They did an interesting further breakdown of exactly how gamers are spending their digital dollars in the chart below.

In looking at the data under the chart above broken down by age groups — “cosmetics/skins purchases are more popular with younger than older payers.” This makes sense to me — unlike older players, they are wired to live and present their image, including their status, just as much online as offline. As younger demos continue to own less physical goods and spend more time online, this trend will only continue.

In terms of market size, in Q1 2018, Activision alone delivered a record $1 billion in in-game bookings. And while he didn’t state the future opportunity in terms of size, CEO Bobby Kottick did call both mobile gaming and in-game revenue streams “two especially large opportunities ahead of us.”

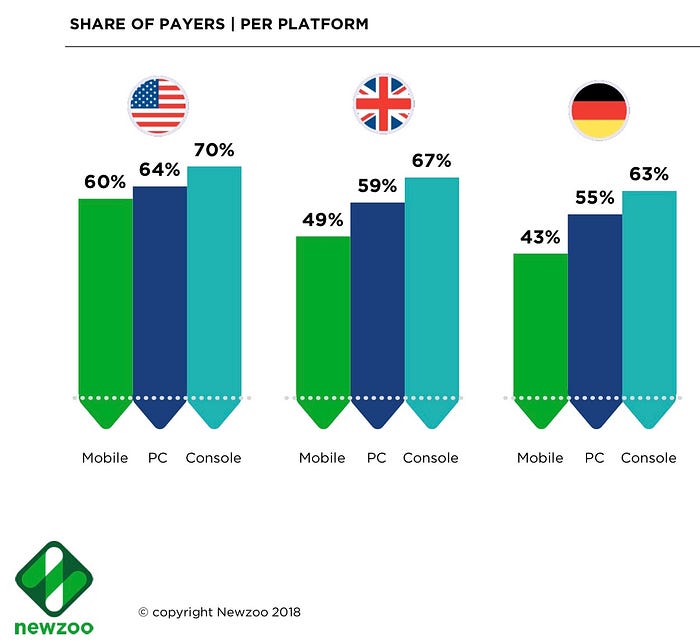

Second, the topic of gender in gaming is also really interesting to me. A few years ago when I was first intrigued by eSports, a common refrain among media investors was, “How valuable are these viewers? Aren’t they just guys playing in someone’s (aka “Mom”) basement? Ummm, no! As time goes on, there is more and more gender balance in gaming. This is really important for advertising dollars because women hold the Gucci purse strings in most households so getting to their eyeballs is meaningful. While mobile is the fastest growing, payment is the lowest on this platform so far. Still, the data under this chart in the UK at least reported that the difference between men and women was fairly small — 49% of men and 48% of women who play mobile games spend money on them.

Santa Monica based Super League Gaming hosts cloud based, PC and mobile gaming for the roughly 2.6 billion players (the 99% of gamers not considered pros) of Minecraft, League of Legends, Clash Royale and others that are coming. Their 16 city leagues act like an offline home base for the online network of retail partners who may license the network and the brand, similar to the way McDonald’s select retail locations serve as best practices examples for the enormous web of franchises who license the platform. Super League is seeing a very wide swath of amateur gamers and on the topic of gender, as CEO Ann Hand puts it, “Upwards of 40% of participants in youth league events are girls.”

Back to blockchain and digital assets one can truly own.

The first real example of a Cosmetic Collectible in the blockchain world was Cryptokitties, which launched on November 28, 2017 and in less than a week, they became quickly known as the cats that clogged the Ethereum network.

Going back to NFT technology, every cryptokitty is uniquely designed with a 256 bit DNA, sold to a user, and validated through the blockchain. Only the user who purchases it, not the game developers,can give permission to sell or transfer it. For example, if Alice purchases this cryptokitty for the going price of $100,000, and she never gives permission to sell it, depending on its value, it could be listed in her last will and testament!

So why hasn’t this happened until now in the blockchain world?

The Ethereum protocol was released in 2015 and in talking to most investors, if the topic is blockchains (as in Layer 1 protocols), we spend most of the time discussing the Bitcoin and Ethereum protocols. We compare them in terms of use cases and transaction speeds. For Ethereum specifically, a recent hot topic has been that it has finally been deemed not to be a security, which inevitably leads to the topic of security tokens and whether they will eventually replace traditional fundraising and whether institutional investors are ready given the state custody etc.

One topic that is less often discussed among investors is that there are a lot of new blockchains (again, as in Layer 1 protocols) in addition to Ethereum and Bitcoin that were either recently released or are coming down the pike.

The reason this is important is because the Ethereum and Bitcoin blockchains use “consensus over state” so all of the computers on the network verify the current state of the blockchain to confirm transactions. As described by James Risberg on CoinCentral in December 2017, the blockchain is a graph of the state of the system so with every new block that is added to the system, nodes on the network look at each transaction from the block and update the state of each address associated with those transactions. This takes a long time. In other words, the level of security is maintained at an extremely high level at the expense of speed. Ethereum speed in terms of transactions per second (TPS) is commonly cited as 15 TPS compared to millions of transactions per second for Visa and Mastercard. According to blockchain.com, the Bitcoin protocol continues to hover around 2–4 TPS, with sporadic spikes to 8–10 TPS.

Another reason unique digital assets are possible now is because Cryptokitties brought a new type of token standard launched at the end of 2017 called ERC-721, which would allow for unique representation on a blockchain. Taking a step back, ERC stands for Ethereum Request for Comments. A good overview of Ethereum tokens (other than the more recent ERC-948) here explains, “An ERC is authored by Ethereum community developers in the form of a memorandum describing methods, behaviors, research, or innovations applicable to the working of the Ethereum ecosystem. It is submitted either for peer review or simply to convey new concepts or information. After core developers and community approval, the proposal becomes a standard.”

The new ERC-721 standard for tokens allowed each token to be unique or non fungible. Prior to this, the ERC-20 standard for tokens was the most widely used for Ethereum’s other use case — ICOs. ERC-20 tokens are fungible in that each token can replace another, which is useful in trading. While the ERC-721 standard was a major milestone, the token still depends on the underlying Ethereum protocol, which hasn’t been suitable for gaming due to transaction speeds. Given this, one would expect other non fungible token standards to come to market as Ethereum evolves and with many other new blockchains.

The need to lead with speed.

In looking into new blockchains which have either just arrived or are launching this year, they all have their own features, pros and cons, and use cases, but one feature they have in common is speed, certainly a requirement for the use case of gaming.

Generally it makes a lot of sense to me that in the same way we wouldn’t use one programming language for all applications, we won’t end up with one blockchain for all use cases.

EOS — the blockchain for startups

Tezos — the blockchain for governance purists

Dfinity — the blockchain that aims to serve as a cloud services platform that will go beyond financial services (toward AWS)

Cosmos — the blockchain for creating open air markets and communications between blockchains— likely a natural host for NFTs

Polkadot — the blockchain for exchanging information and trust free transactions between blockchains — likely, a natural host for NFTs

Finally, lets not forget that Ethereum will not be standing still. While its Layer 1 protocol may not accelerate in an effort to maintain its security, it is exploring Layer 2 solutions, or “side chains” in an attempt to be a suitable platform for more applications like gaming.

Regardless of who wins the underlying technology battle, it does appear that the moment for video gaming and blockchains to cross paths has finally arrived!

Many thanks to Max Fiege for his help. Meeting Max was a good lesson to talk to everyone at Solidity boot camp — you never know who you will meet.